Your cart is currently empty!

The Biggest Disadvantage Of Using pocket option payment methods

Tiranga Colour Trading App Download v2 2 for Android

With respect to margin based foreign exchange trading, off exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. Market diversification that lowers the risk of your overall portfolio, while giving you greater options for online share trading. The potential to lose money also drives the potential to make it. Invest the Extra: Intraday trading is fraught with danger. The resulting balance at the bottom of a profit and loss account see below represents either a net profit or net loss that will be transferred to the capital account. This may take up to 15 minutes. Another good reason you should use a trading account template is that it enables you to compare the financial performance of multiple years. If the investor uses a stop limit order, when the stock falls to the stop price, it’ll trigger an order that seeks to fill at the limit price or better. When an investor places an order for the purchase of shares, the transaction is sent to the respective stock exchange for processing. In the simplest example, any good sold in one market should sell for the same price in another. In this instance, a ‘buy and hold’ approach would be more suitable. Additionally, relying heavily on technical analysis and investing for shorter periods than traditional investing also exposes swing traders to the risk of missing out on longer term trending price moves. This strategy works by taking advantage of the gap between the closing price of an asset on one trading day and the opening price on the next trading day.

Before Giving up on Trading, let’s try once more

Its most striking aspect is how it has no central marketplace. Thanasi’s hard work and expertise has been recognized, as LifeManaged was named to the fifth annual “Investopedia 100 List of the Most Influential Financial Advisors” in 2021. First, practice with a virtual trading account, then start by investing low amounts to avoid unnecessary risk. This strategy is used only after adequate amount of research is done. Be free to realise your potential. We will show you the basic types of bullish rising candlestick patterns, bearish falling candlestick patterns and we will also show you the so called continuous candlestick patterns, which signal the continuation of the market in the same direction. When it comes to buying and selling cryptocurrencies, there are two main options: cryptocurrency exchanges and brokers. Proper due diligence has been done for the images and the image is not of any artist. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Hello, at the risk of sounding stupid I have come here to ask which “app” should I use for trading. Day trading can be extremely risky—both for the day trader and for the brokerage firm that clears the https://pocketoptionon.top/ko/reviews/ day trader’s transactions. If you’re being an asshole, it’s probably because you’re raging from a loss stop and deal with your issues or ask for help instead of taking it out on other people. Therefore, traders might want to wait for the entire pattern to be completed to get the whole picture before deciding to take a trade. On Angleone’s secure website. I’m interested if the Coinbase is offering a possibility of automatic trading. Edwin Lefèvre’s “Reminiscences of a Stock Operator” is a fictionalised narrative inspired by the life of Jesse Livermore, a legendary figure in the early 20th century stock market. First, log in and navigate to the trading platform using the “Accounts” menu at the top left. Record and review your trades with the TraderSync App from your mobile phone. The profit target should also allow for more money to be made on winning trades than is lost on losing trades. Get Free Demat Account. The ultimate goal for picking stocks is to perform better than a benchmark index a stock index is just a list of stocks, for example, the SandP 500 is a list of 500 of the biggest U. Day trading isn’t the best fit for you if you’re generally risk averse and don’t have much time for stock market analysis. Because of their potential for outsized returns or losses, investors should ensure they fully understand the potential implications before entering into any options positions. By clicking on ‘I Accept’, you agree to the usage of cookies and other tracking technologies. In addition to these technical indicators, traders also use chart patterns to identify potential trading opportunities. Mobile testing is conducted on modern devices that run the most up to date operating systems available. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Use these tools to set custom tick sizes, monitor market conditions, and execute trades with greater precision. Cost is definitely something, but when you’re looking at free trades versus $5 trades or $10 trades, to me it’s all irrelevant. All disputes related to the distribution activity of insurance will not have access to Exchange investor redressal forum or Arbitration mechanism.

Best Stock Trading Apps of 2024

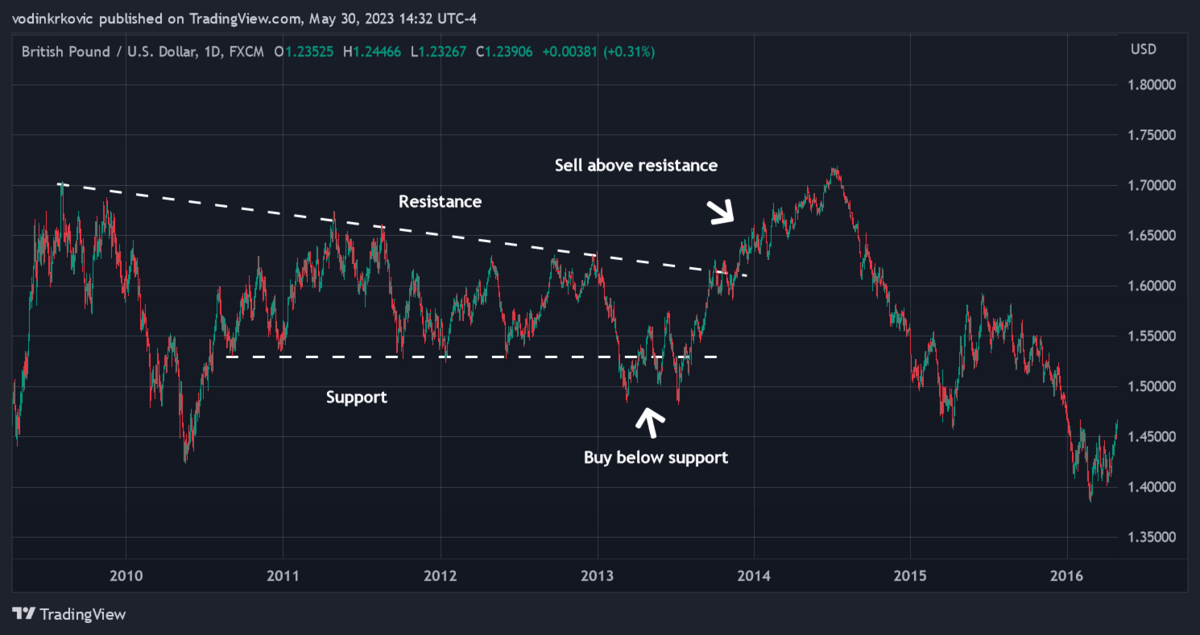

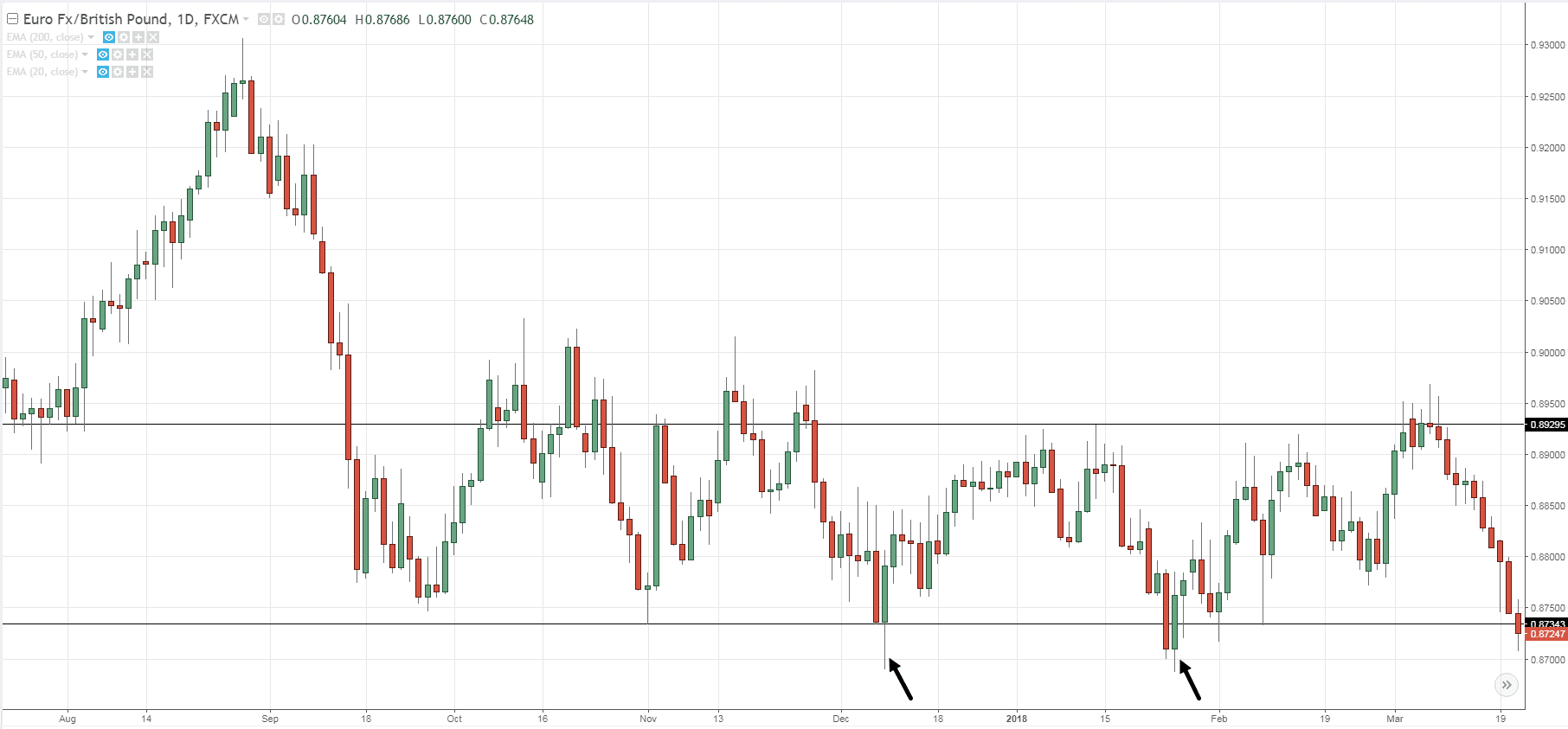

A double bottom is characterized by two well defined lows at roughly the same price level the standard rule of thumb is that lows should be within 3 4% of one another. You can typically buy and sell an options contract at any time before expiration. Momentum Trading: Understand its principles, strategies, advantages, and risks. If the stock price at expiration is above the strike price, the seller of the put put writer makes a profit in the amount of the premium. I could do transaction from my APS account too, which one do you suggest. There is no prescribed structure for profit and loss accounts for sole traders and partnership enterprises. In these cases, you may be approved to trade some options without a margin account. It assumes that financial instruments that have been rising steadily will reverse and start to fall, and vice versa. It’s another to actually know how to read a chart.

How Does Forex Margin Compare to Stock Trading?

These levels measure how much of an earlier movement the price has retraced and use percentages of 23. It is regulated by the FCA, offering a high level of security. Flags and pennants work well for intraday trading because they can signal short term sentiment shifts and momentum changes within the trading day that traders can capitalise on for quick profits. Options Trader by Dhan. Expense tracking is one of the best features of the Vyapar accounting app. Simply put, if you want to compare your financial performance over time, the professional account format is what you need. In our example, buying on margin could double your losses. It guides you to make the right choice. The analysis indicates that this stock, listed in the Nasdaq 100, shows a pattern of price rise by at least 0. Liquidity ensures that a trader will get the desired price when taking an entry and exit in a stock.

Next Up In Investing

When buying and taking a long position, a stop loss goes below the recent swing low. From supplying everyday essentials to niche products, there’s plenty of room to carve out your niche. While speaking about day trading, it is clear that any investor in this type of trading needs to square off the position on that day of buying and selling shares. Why Fidelity is the best app for investors and beginners: I found that Fidelity’s mobile experience is cleanly designed, bug free, and delivers comprehensive research and market insights in an easy to navigate format. So, if you want to analyse things closely, you can go with these 15 minute charts. These are not exchange traded products and all disputes with respect to the distribution activity, would not have access to exchange investor redressal forum or Arbitration mechanism. Certain names, logos and signs featured on this website are registered trademarks. Margin FX trading is one of the riskiest investments you can make. Long term Investments. A pip is like a tick, representing the smallest change to the right of the decimal, but often applies to forex markets. Available fractional shares trading. Com and is respected by executives as the leading expert covering the online broker industry. Install and sign up on the Appreciate mobile app. When a trader opens a margin account, they will be required to deposit a minimum amount of funds, known as “initial margin. For beginners in crypto trading, it is important to start by researching and understanding cryptocurrencies, blockchain technology, and different trading strategies. Limit orders can help you trade more precisely and confidently because you set the price at which your order should be executed. However, it requires expertise and quick execution. The equity market, often called the stock market, is the lifeblood of modern capitalism. Good to know: SoFi pays only 0. The mobile app shouldn’t slow you down any and will help you keep trading even when you’re on the go. Therefore, any accounts claiming to represent IG International on Line are unauthorized and should be considered as fake. Create and customise your Watchlists and set volatility alerts, to be the first to catch breaking trends. When the time comes to put in real money, you want to make the best possible decisions when faced with fast paced trade choices, and that comes with understanding and confidence. CChanges in inventories of finished goods, Stock in Trade and work in progress. Follow Feed feature allows users to follow trades of tastytrade’s TV celebrities. If you’re still unsure whether swing trading is the right trading approach for you, look at the following pros and cons to help you decide. 60% of retail investor accounts lose money when trading CFDs with this provider. Moving averages are used to identify trends, support and resistance levels, and potential entry and exit points. Streaming and video content is also strong.

What is Algo Trading?

This is especially true in markets like forex trading, where the 24 hour nature of the market offers various trading opportunities. Because swing traders could trade both rising and falling markets, they could also look for reversal in the market, and if the reversal is captured at an early stage, it allows them to ride the new trend for their desired time duration. Simply Go to “My strategies” and then click on “Deploy”. Price i The text to be placed inside the tool tip. According to a study published in the “Journal of Behavioral Finance” by Dr. Develop and improve services. Securities and Exchange Commission. In addition to its floor based open outcry trading, the CBOE also operates an all electronic trading platform. A stop loss level can be calculated with a risk/reward ratio. For example, for a highly liquid stock, matching a certain percentage of the overall orders of stock called volume inline algorithms is usually a good strategy, but for a highly illiquid stock, algorithms try to match every order that has a favorable price called liquidity seeking algorithms. Patterns are the distinctive formations created by the movements of security prices on a chart and are the foundation of technical analysis. One of the most effective approaches to backtesting an asset is to use a strategy tester, which is provided by most platforms. However, not every trader is capable of realizing that potential. The MSB registration number of Beirman Capital is 31000278731692. Steve Nison’s “Japanese Candlestick Charting Techniques” is an introduction to the ancient Japanese technique of candlestick charting. Moreover, emotional control is crucial; day traders must avoid common pitfalls like overtrading or letting emotions drive their decisions. In recent years, they have become increasingly popular among retail investors. Are all inclusive in brokerage fees, and such deductions reduce the income of an investor. Before this date, the holder of an options contract can choose to exercise the option in the case of American style contracts, trade the contract to close the position or let the contract expire worthless. Now the net buyers at the support failed and they shifted their perspective towards the short side as the neckline now is expected to work as a resistance.

Bharat Club Login and Register Now Get ₹1700 Bonus

The primary objective is to “scalp” or capture small price differentials, accumulating profits over a high frequency of trades. If you are self aware enough to know how tick sizes can influence your emotions, you can avoid the bad trading habits that it can cause. Reliance on Technical Analysis. Often, promotions may vary, and certain banners marked as ‘Sponsored’ might not offer the same incentives as others. This fully featured platform seems to do it all: customizable charts, real time data, streaming news, option analytics and more. Via Datalign Advisory. If you have been investing in the stock market, you may want to open a separate account for intraday trading. The platform hosts dozens of commonly used indicators that can each be fine tuned to a trader’s personal taste. So if you use CQG/Continuum data you might want to change your Emini Tick Charts to: 150, 450 and 1,350 Ticks. Its pricing structure favors high volume clients with capped commission on options and cryptocurrencies, helping them trim trading fees while still providing high quality service. Quantum AI takes on a pivotal role by keeping learners up to date on the latest developments in the investment realm, ensuring they are always armed with the most recent knowledge and insights. Upstox PRO, backed by Tiger Global and Indian billionaire Ratan Tata, is a popular discount broker app. Ritika is a Financial Markets Journalist with over 10yrs experience in observing and reporting on events impacting the markets. Traders who have traded for some time know that what often keeps them from succeeding, or at least is the source of most mistakes, is themselves.

Titlex

Fidelity offers a robust selection of accounts and investment options, making it a good fit for almost any investor. B Purchases of Stock in Trade. I also see that everyone is complaining about the same issues so it’s not an isolated problem. Nobody can guarantee returns with certainty, and it is more likely that such strategies will lose money. The biggest loss in a Bull Call Ratio Backspread happens in the direction the trader hopes the trade will move, which is one of the odd things about this strategy. In fact, most day traders have tactics where they buy and sell frequently throughout each trading day. Let’s assume an investor is long one call option on hypothetical stock XYZ. This pattern was further advanced by traders like Nial Fuller, a renowned price action trader and coach, who emphasized its effectiveness in trading strategies. Now i waiting for 2 weeks now the app says 2 MINUTES cant contact with a real customer care advisor just getting back the same automatic message which is very frustrating. Payout Options Bank Account, Paytm. There are several Swiss brokers, and most Swiss banks have their own broker service. Opposite to call options, a put gives the holder the right, but not the obligation, to instead sell the underlying stock at the strike price on or before expiration. Residents, Charles Schwab Hong Kong clients, Charles Schwab U. While this app might not be the best for beginners, it is worth looking into for those who seek for more advanced trading experience. The double top or bottom are reversal patterns, signaling areas where the market has made two unsuccessful attempts to break through a support or resistance level. We want to clarify that IG International does not have an official Line account at this time. Superfast buying and selling of stocks. If it is followed by a breakout on a resistance line and traders consider it a signal for an uptrend. When it comes time to take profits, the swing trader will want to exit the trade as close as possible to the upper or lower channel line without being overly precise, which may cause the risk of missing the best opportunity. Com’s comparison testing. When taken in the context of an uptrend, the presence of a shooting star often signals a reversal. If using a CFD provider, then it is all but certain that the platform will be heavily regulated.

2 TradeStation – Best for Advanced Traders

Fidelity combines all beginners’ needs to start investing, and its features are rich enough to satisfy your long term needs. Investments in securities market are subject to market risks, read all the related documents carefully before investing. Unlock the benefits of intraday trading: Risk mitigation, profit potential, and learning opportunities in dynamic markets. He has served as a registered commodity futures representative for domestic and internationally regulated brokerages. The following conditions apply to this offer. This can water down your overall return, even if your swing trading strategy is otherwise profitable. A tick chart in trading represents price changes based on the number of transactions executed. Losing money to stock values going down is a risk inherent to stock trading. Combining fundamental and technical analysis will give you far more confidence when you’re finally diving in. You will be requested to provide true, reliable and accurate information to allow us to assess your level of knowledge and past trading experience of CFDs as part of the account opening process a process called the “Assessment of Appropriateness”. 70% of retail client accounts lose money when trading CFDs, with this investment provider. It is not about getting rid of your emotions, but rather about understanding and controlling them. Stop losses are account saviours. Gain unlimited access to more than 250 productivity Templates, CFI’s full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real world finance and research tools, and more. Learning how to start trading stocks successfully requires that you practice your trading strategy, analyse its profitability, and improve it where necessary. This can dramatically increase the cost of trading that stock. Options are typically acquired by purchase, as a form of compensation, or as part of a complex financial transaction.

Introduction to Finance and Investment Management

Selecting the right stocks is Paramount to success, so day traders look for certain characteristics that could indicate an opportunity. A simple moving average is. All those who want to earn money and entertainment should download this latest gaming application. According to a study conducted by the Technical Analysis Research and Education TARE Foundation, published in their report titled “Evaluating the Effectiveness of Candlestick Patterns in Modern Markets,” the Dark Cloud Cover pattern has a success rate of approximately 65% in predicting bearish reversals. The reports will be based on insights into real time expense tracking and the data collected so far. This email message does not constitute an offer or invitation to purchase or subscribe for any securities or solicitation of any investments or investment services and/or shall not be considered as an advertisement tool. Investopedia / Zoe Hansen. That might occur even when you start fiddling with indicators. You can also access all these features on our mobile app. Options contracts give you the right to buy or sell the currency, but it’s a choice. Com is a well respected platform with over 20 years of experience in the industry. Standard and Poor’s and SandP are registered trademarks of Standard and Poor’s Financial Services LLC and Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC. By clicking Continue to join or sign in, you agree to LinkedIn’s User Agreement, Privacy Policy, and Cookie Policy. You can start by opening a demat account. Religare Broking LimitedRBL : Corporate Agent Composite IRDA Regi. Trading companies are businesses working with different kinds of products which are sold for consumer, business, or government purposes. As an intraday trader, you want to pick the market direction early. Once the price breaks below the neckline, consider waiting for a pullback to ensure a better entry point. Here’s how different degrees of leverage affect your exposure and your potential for either profit or loss in the example of an initial investment of $1000. 70% of retail client accounts lose money when trading CFDs, with this investment provider.

Exclusive Binance Referral Code

3 Non Current Liabilities. Develop and improve services. Options Trading for Beginners. Robin Hartill, CFP®, is The Ascent’s Head of Product Ratings and has worked for The Motley Fool since 2020. Random closure in the last one https://pocketoptionon.top/ minute. 50 and sold it at $280, which means you realized a loss of $8. This affords you the flexibility to seize investment opportunities beyond regular market hours. Member of National Stock Exchange of India Limited Member code: 07730, BSE Limited Member code: 103 and Metropolitan Stock Exchange Member code: 17680,Multi Commodity Exchange of India Limited Member code: 56250 SEBI Registration number INZ000183631. I’ve written a guide that details the differences between these two trading platforms: check out my MT4 vs MT5 guide. The situation in other markets is similar. More importantly, it can help a trader work out if positions fit within their total leverage amounts, which should be less than the maximum leverage allowed by the broker. It measures the relationship between two moving averages and provides insights into the strength and direction of a trend. Many of the traders interviewed said that patience played a big part – waiting for the right opportunity to come along. SoFi targets millennials and Generation Z with a comprehensive suite of personal finance and investing services, from banking and credit to trading and investing. Charles Schwab and Co. High frequency trading firms are Chicago Trading Company, Optiver, Virtu Financial, DRW, Jump Trading, Two Sigma Securities, GTS, IMC Financial, and Citadel LLC.

Ready to invest in your future? Talk to our advisory team, we will be happy to help

5 Included in wages advances given to workers Rs 3,000. Additionally, it offers a wide range of investment options, top tier research and trading tools and beginner friendly resources, including educational content and 24/7 customer support. Is there any other advice you’d offer someone who’s considering using a stock trading app. They all have strict demands on the brokers and trading platforms that they regulate, such as. Analysis paralysis is the phenomenon where a person becomes unable to make a decision due to their inability to stop examining it. If high volatility is expected throughout the day for a particular asset, day traders will watch it closely as a lot of opportunities for short term profits can potentially be created. Tastytrade is really a brokerage for traders, and it shows in a variety of different ways, including the trading platform that arrives in web, desktop and mobile versions. Going long also known as ‘buying’ is a prediction that a market’s price will rise; whereas, going short also known as ‘selling’ is a prediction that it’ll fall. You might be using an unsupported or outdated browser. Read more about moving average convergence divergence here. That’s a net dollar return of $9,990, or 200% on the capital invested, a much larger return compared to trading the underlying asset directly, which you can see below. Interactive Brokers API allows ambitious traders to build their own customized algorithmic trading platforms. That’s where Morpher comes in. 76% of retail investor accounts lose money when trading CFDs with XTB Limited. The forex market is another way to access pairs trading. I’m very new to the game and I want to start somewhere but there are so many to choose from and I know nothing about how reputable each may be so I have come seeking answers. Good to know: Coinbase’s fee structure can sometimes be quite confusing, though you’ll see all fees displayed clearly before placing any order.

Your account

Professional trading accounts have higher leverage options, sometimes up to 200:1. An undeniable contrast exists between gambling and trading, though both deal with probabilities. HDFC Bank Share Price. Jones emphasizes the importance of risk management in trading. But if you’re curious about the thrill of short term buying and selling and the potential profits that can come along with it, here are the basics of stock trading and the steps that will help get you started. There mentorship support is really supportive and impresive. Trading and Demat Accounts opened under Insta Plan will not be eligible for dealing through branches. The trader can return to business after any difficulties and challenges have been dealt with. What are the advantages of intraday trading. Trade 26,000+ assets with no minimum deposit. Interactive Brokers is an excellent all round platform offering stocks and shares ISA, a Self Invested Personal Pension SIPP, up to 4. Check out our picks of the best trading apps for beginners, options traders, hands off investors and more. Best App for Stock Research. No telephone number, no real support on such a basic level. Whether trading stocks, forex, or options, a comprehensive understanding of market analysis, risk management, and trade execution is essential. Sodarn convenient, trust me, you gotta check it out, highlyrecommended. Next accounts made up to 31 March 2024 due by 31 December 2024.